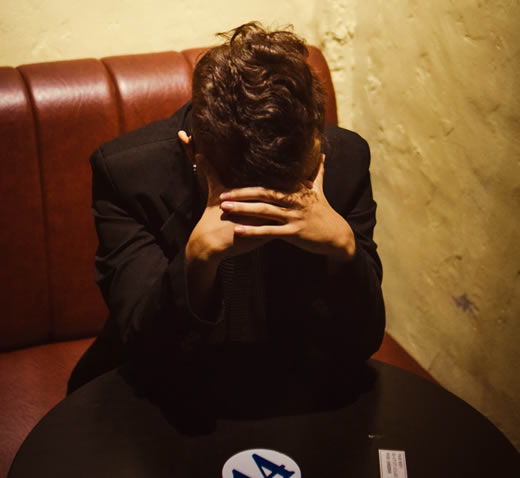

Over and over we see families where one member becomes alienated from the other family members yet ends up the determining factor in the future of the family’s business. The individual may distance themselves from other family members to the point of not talking to family members for years. Their behaviors are often rooted in longstanding unhappy feelings towards other family members, deceased parents or be afflicted by drugs, alcohol or criminal-type behavior. Typically the parents in order to be “fair” to their children want non-involved children to benefit from the family fortune. So these family members are often shareholders of the company and receive normal dividends and other benefits. Why does this occur and what are the implications for family governance?

There are usually long histories to these stories, often involving favoritism and spoiling of the child when he or she was a child which fed feelings of entitlement and irresponsible behavior. Take the case of the Alvarez Family. Peter and his wife Mary had five children. Gustavo, Jorge, Alberto, David and Cecilia. Jorge died as a young child due to illness. Alberto, the middle child was particularly loved and adored by his father. David did well in school, was sent to the USA to study law, married an American and settled in Dallas.

Alberto had difficulty in school and early in life developed the habit of lying to his parents and teachers. In fact when he “graduated” from college in the USA and sent his parents’ pictures of the celebration it was actually not true. He did not graduate! As a young adult, he asked for and received money from his father for fast cars, apartments, etc. which (as one of the sons of a very successful businessman – he felt entitled to. At the age of 25 he joined his brother Gustavo in the family business.

Although his brother had already been working in the business for over 10 years and had a much more substantial position Alberto insisted on equal pay. This infuriated Gustavo and the brothers grew increasingly hostile towards each other. Gustavo considered his brother to be quite incompetent (which was shared by board members) and felt that he was always cleaning up his Alberto’s messes. After several years, the only way Dad could manage his two sons was to have Alberto work in a facility in a different city.

Cecilia was interested in the business however the father insisted that she not work in the business. Dad always said “You should concentrate on the finer things in life. I’ll make sure you are always very well taken care of”. This conflict escalated to point where Dad and the daughter barely spoke for two years. Further, Cecilia became furious at her brothers (particularly Gustavo) whom she believed convinced Dad not to hire her. Over time she grew more and more distant from Dad and her brother Gustavo although she remained close to Alberto and David.

Over time the distance grew between Alberto and Gustavo. Gustavo’s lack of affection and respect for his brother grew. Alberto considered himself the smart one – after all he got plenty of money for little work (his facility was much smaller then the major operation in Bogota) although he worried that his brother was really taking advantage of Dad through high salary and company perks. When others confronted Alberto, he would get more and more aggressive. Whenever Alberto complained to his father about needing more money, the father gave him personal monies to “keep things equal”.

Over the course of 30 years, Gustavo became the CEO. Alberto developed a drug problem, attended several quite expensive Rehabilitation Centers in the USA and constantly said such statements as “This time I’ll really beat this problem. If not for Dad, I would never make it. Money is to use and enjoy anyways. Dad favors and overpays my brother who has ruined the company”. There was little communication between the two brothers and even less with their sister who eventually moved to the Spain and their brother David who had become very successful in the USA. There was even less communication between the children of each (the third generation).

At the age of 80 the father and mother passed away. Through the use of offshore companies and expert legal maneuvering, a quite brilliant international estate planner was able to plan the estate according to the patriarch’s wishes. Gustavo and Alberto were each left 30%, David who the father considered the most successful and therefore not needing financial support was left 15%. The sister Cecilia who had the most children and in the father’s eyes needed financial support was left 25%.

Within a year’s of the passing of the parents, it was clear that any major decisions were actually made by whoever courted Cecilia’s vote – after all she had the deciding vote – and usually it was Alberto. Imagine, after 60 years – the major decisions were now made by the family shareholder with the least amount of interest and understanding of the business.

Our next article will provide a way to not only avoid this catastrophe but to construct a wealth, family and business succession according to the family’s highest values.

Marc@sii-inc.net